A Realtors Take On The August Market In Oklahoma City

Can you believe that August has come and gone?! Shoot, I can’t even believe that we have made it through the first week of September already. This summer flew by all while simultaneously crawling at the same time. Now that kids are back in school, people will begin to get back into the swing of things and their routines. That goes for us included! It seems like we’ve gone all summer long without a real estate market update. So what better time! Not only is it the first market update that we are providing one the new website, but it’s the first blog post as well! That said, let’s dive in!

The real estate market in Oklahoma City has been experiencing some noteworthy shifts in recent times. From August 2022 to August 2023, there was a notable 6% surge in the average sale price across several key cities in the region. However, despite this surge, the historic number of listings is still not quite up to pre-pandemic (2019) levels. Let’s dive into the specifics and see how the OKC market is faring. While looking up this data, somethings definitely came as a shock to us, while other stats, not so much. Here is what we found.

Average Home Sales In OKC Metro

On the left is the average real estate sales price in the OKC Metro area. What we are seeing here is that from August 2018-August 2023, there is a 50.9% increase. From August 2022-2023 there is 6.01% increase. If you will also notice, from August 2018 to 2019, there is only a year over year increase of 3.82%.

What does that tell us? That pre Covid, real estate was still a great investment with a 3% return year over year. But post Covid, real estate is holding stronger than ever as being one of the best investments for an individual or family.

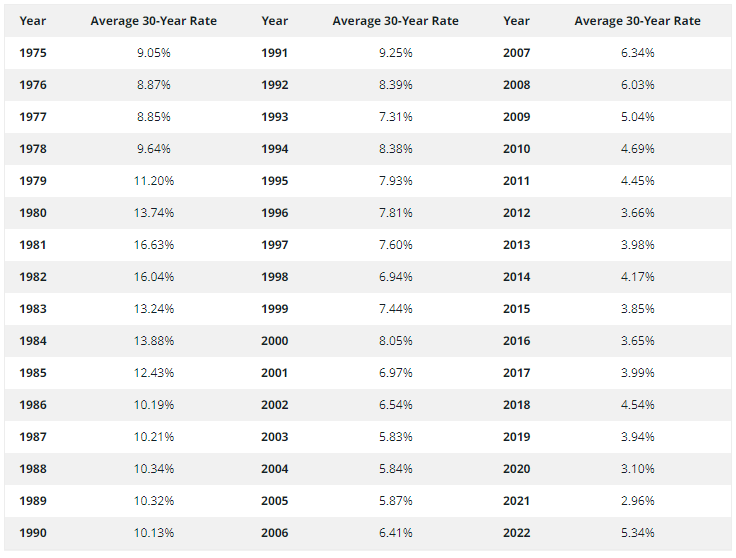

Historical Interest Rates

Thank you to one of our local lenders, Taylor Ortiz with Fairway Mortgage, he sent us this report of the average interest rates over the years. As you can see, there are some crazy high interest rates and some crazy low interest rates!

Let’s break this down a bit, shall we? 2018 and 2019 are pre Covid years with the “average” interest rates sitting at 3 and 4%. But again that’s the average. In that time frame, there were still some people who were being quoted 2% while others were being quoted 6%. Interest rates vary person to person. So while we only see the national average, we can’t forget those who sit below average and above. And that statement stands true today. Yes, interest rates have increased, but over the national average, they are right on par with the past years average. When I closed on my home in April of 2019, my interest rate was in the 6% range. However, you’ll notice that in 2019, the average interest rate sat at 3.94%. I never once NOT considered buying a house because I was paying 3% more in interest than the “average” American. I was just happy to have a home.

Now, is that to say that everyone should purchase a home regardless of the interest rates? No! That is not what I am advising at all. If it is within your means to do so, then yes, you absolutely should for the main reason being, that your investment is in fact increasing in value year over year. If it is attainable, do it so that you can build equity for yourself and your future. If it is not possible now but it is in the future, let’s set you up with a game plan on how to be successful in your future home purchase.

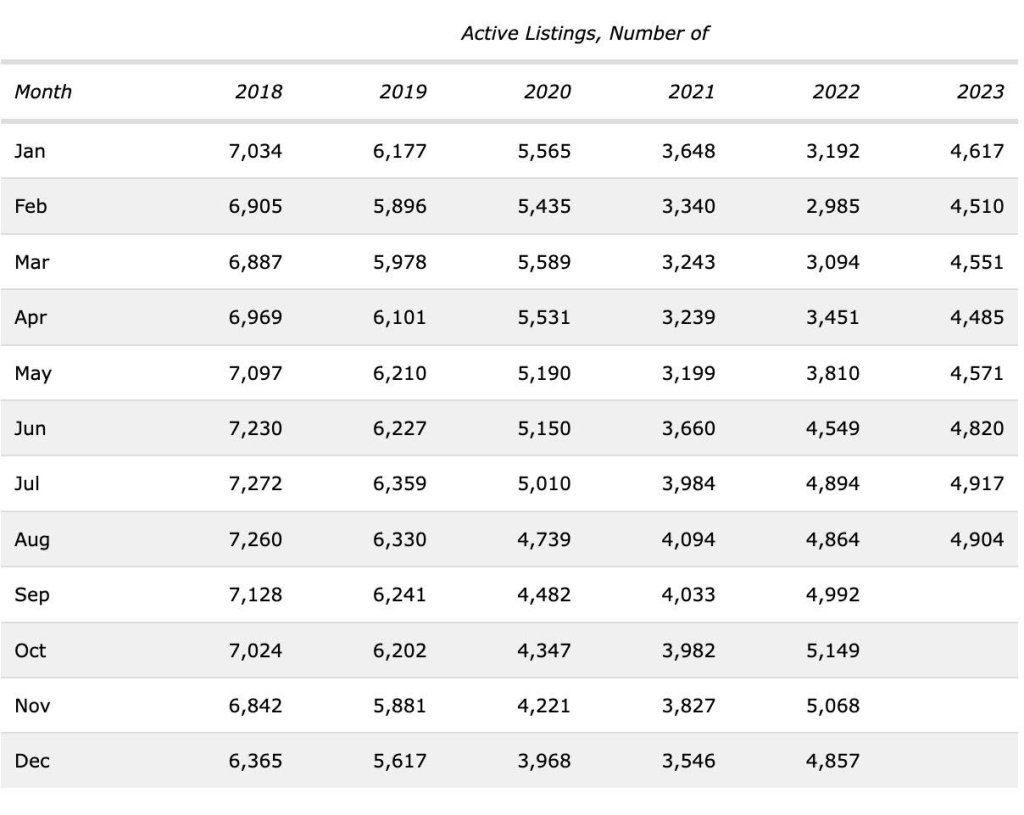

Active Homes For Sale In OKC Metro

We have discussed the average sales price increase and interest rates, let’s discuss the average listings. Pre Covid numbers in August of 2018 had 7,260 listings just in that month alone! This year there were 4,904. That is a decrease of 32.45%!

What does that tell us? That we need more listings!!

We love a good statistic as much as the next person, but what we love even more (as we’re sure that you do too) is real life accounts of the current market. Here is where Mechling Group stands for the month of August 2023.

- 28 total showings on our listings.

- 27 active showings to our buyers.

- 3 home inspections.

- 3 total pending sales.

- 1 new listing.

- 1 closing.

Why August?

Although August was a relatively slow month for us, historically, that is common. The week of August 8th was the first week back to school in most cities. Some started a week or so later. But that is very indicative of a slow month. Parents are dealing with the stress of back to school clothes shopping. Supply shopping. Sports starting back up. Therefore, unless someone is in an absolute dire need to purchase, people tend to place home searching on hold for the month of August just to get them through the back to school chaos. Now that we are about a month into the school year, the amount of listings and showings will slowly begin to increase.

Where OKC Stands On A National Level

Looking beyond OKC, the national picture provides some interesting context. In July, pending home sales increased in both the Midwest and South, while they decreased in the Northeast. There is still a large population of people from the coast moving to the Midwest and other southern states.

Rising Sale Prices: The most significant highlight of this period is the 6% increase in the average sale price. This surge indicates a healthy demand for properties in the region, potentially driven by a combination of factors such as low interest rates and a robust local economy.

Historic Listings Lagging Behind: Despite the positive movement in sale prices, it’s worth noting that the number of listings still hasn’t fully rebounded to pre-pandemic levels. This suggests that while there is strong demand, the supply of available properties may still be catching up.

OKC’s Resilience in the Face of Recession: One of the most reassuring aspects of the OKC market is its resilience. Reports show that the overall market in Oklahoma City has displayed an upward trajectory year over year, even during uncertain economic times. This resilience positions OKC as one of the most recession-proof cities in the United States.

Is The OKC Market Strong?

The real estate market in Oklahoma City has shown remarkable resilience and growth over the past year. The 6% surge in average sale prices coupled with an overall upward trajectory in market reports positions OKC as a robust and potentially recession-proof market. However, it’s crucial to keep an eye on the supply side, as historic listing numbers have yet to fully recover. For those considering buying or selling in OKC, it’s a dynamic market worth paying attention to.

We can’t wait for next month’s update so that we can see the stats for September 2024 and see if my prediction of homes sold in August vs. September is accurate. Stay tuned….

Sincerely,

Madisen + Shay